Data Analysis: Solar and wind opportunities surge in MENA

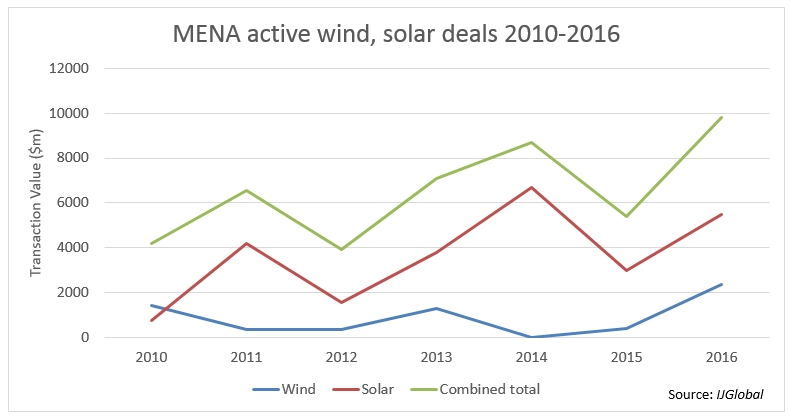

The value of active pipeline and procurement wind and solar energy deals in the Middle East and North Africa (MENA) region reached a new peak of $7.8 billion in 2016 and is trending upwards, according to IJGlobal data.

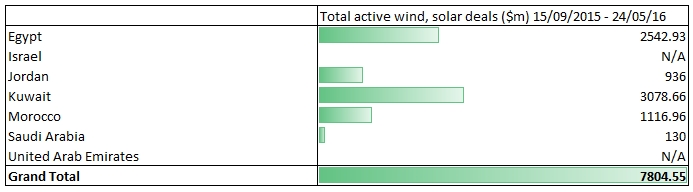

Total value of active deals in the region’s onshore wind and solar industries came to just over $7.8 billion in the nine months to 24 May 2016 – a significant jump on the $6.45 billion of open opportunities at the same time in 2015.

Globally, active wind and solar deals amount to $58 billion over the same period. Europe represents the largest slice with $30 billion of active deals in the market.

Kuwait accounts for the most valuable active renewable energy market in the MENA region. The country’s renewables sector has a total deal value of $3.08 billion – entirely attributable to the Al Abdaliyah integrated solar combined cycle project. The project is not strictly renewable energy; it is planned to consist of a 220MW capacity gas plant alongside a 60MW solar component. Al Abdaliyah is in the process of selecting a preferred bidder.

Egypt follows behind Kuwait with over $2.5 billion of available deals across a range of wind, photovoltaic and thermal solar projects. The figure represents a significant increase on the $400 million of potential deals out in the market over the same period to 24 May 2015.

Since then, Egypt’s New and Renewable Energy Agency announced the procurement of 550MW of new wind and solar capacity and projects under its 2GW feed in tariff programme have progressed, with signing of power purchase agreements expected in May 2016. Both the European Bank for Reconstruction and Development and the International Finance Corporation have said they are considering lending to the projects.

Active renewable energy opportunities in MENA are predominately in the solar sector with some $5.5 billion of deals across all sub-sectors. In comparison, wind opportunities represent a total of $2.34 billion – though this was a significant increase both on the $400 million of active wind deals available in the market last year and a previous peak of $1.43 billion in 2010.

The United Arab Emirates also offers a number of big opportunities for solar investors although was not included in the data – a final figure for the total cost of the up to 800MW Rashid Al Maktoum phase three development is not yet known. Despite this the project is expected to cost around AED50 billion ($1.36 billion) according to the Emirates’ state news agency, WAM.

Rashid Al Maktoum’s third phase is at the bid evaluation stage after Fotowatio Renewable Ventures, Masdar and Abdul Latif Jameel entered a bid of just $0.02999 per kWh, a new record low price for solar energy. Neighbouring Emirate Abu Dhabi is likewise procuring 350MW of solar capacity with 34 companies and consortia prequalified in April this year although, again, the project’s total cost is not yet known.

Looking ahead to late 2016 and into 2017, Oman could yield a number of opportunities. Oman’s long-awaited tender for up to 200MW of solar capacity is expected to begin procurement in 2016 and the country is also considering development of solar-powered desalination plants in the Musandam Governorate – although a targeted capacity has not been revealed yet.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.