European renewables refinancings rise steeply

Refinancings in the European renewables market has risen steeply year-on-year since 2012, IJGlobal data suggests.

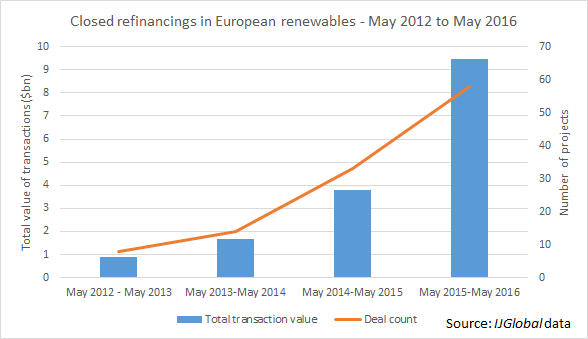

As the chart below shows, over the past four years sponsors have increasingly taken advantage of favourable market conditions to restructure the debt on projects. The total number of projects refinanced has risen in line with the rising total transaction value of those refinancings each year.

May 2012 to May 2013 saw just eight refinancing transactions close in Europe, totalling $876 million. In the following 12 months, $1.66 billion of refinancings reached financial close across 14 deals. Activity took a significant jump from May 2014 to May 2015, when 33 deals closed with a total value of $3.77 billion.

The most recent figures, for May 2015 to the start of this month (May 2016), show that $9.47 billion of debt refinanced 58 deals during the period. This figure was boosted by some major transactions: notably the $1.19 billion Meerwind offshore wind refinancing, which reached financial close in December 2015. UK developer Lightsource had also closed on its $437.9 million solar portfolio refinancing a month earlier.

Alongside these banner deals were plenty of smaller onshore wind and solar refinancings, which made up the bulk of the period’s transactions.

Improved market conditions

Increasing bank liquidity and favourable terms have encouraged this spike in refinancings. Many of the projects refinanced were built in the post-2008 period, where debt available to European renewables was constrained as many lenders temporarily retreated from the market. Debt tenors shortened and many renewables developers, particularly in the onshore wind and solar markets, chose to finance projects with short-term debt or on balance sheet.

As confidence in renewables as an asset class has grown, and markets have slowly recovered, a surge in newcomers keen to lend to renewables projects has widened and deepened the pool of liquidity available. Traditional banks, institutional investors and private equity houses are among those now keen to invest debt in the sector.

What’s more, the underlying assets are now far less risky. They have shifted from being in-development greenfield projects requiring construction debt to being operational assets with predictable feed-in tariffs, and are therefore cheaper to finance.

Looking ahead

The trend looks set to continue into 2016 and beyond. One global law firm told IJGlobal this week that it is focusing its European energy practice on secondary market and refinancing activity for the rest of 2016.

Delegates at IJGlobal’s European Renewable Energy Investor’s Forum, which took place in St. Andrews, Scotland earlier this month, debated how long the period of relatively easy access to liquidity would last, but refinancings were expected to remain a major source of deal activity, according to several lenders.

Moreover, many generous state support regimes that helped boost greenfield renewable development in recent years have now been removed or reduced. The 25-year feed-in tariffs that many of the projects included in the chart above enjoy are, for the most part, no longer available.

Primary financings for solar and onshore wind may slow down as governments try and create a leaner, more competitive renewables market. Solar strongholds like Spain and the UK have already done much to slash existing subsidies. Other European nations – like Belgium and Germany – are also shifting to more competitive, auction-style support systems for renewables.

And so debt providers may continue to take advantage of the projects built during more generous times for subsidies, particularly through M&A transactions. The founder of Spring Park Capital, Jeremy Milne, told IJGlobal that many of the UK solar and wind projects built during what he called the “vintage” years of 2012-13 are now coming up for sale. He estimates some £220 million of assets came to market in the UK in 2015, and expects that figure to rise to £300 million in 2016-17. Once the buyers have used short-term debt to finance their acquisitions, he says they are likely to approach lenders for long-term refinancings of the assets.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.