Data Analysis: Conventional power remains resilient in MENA

The value of active power deals in the Middle East and North Africa (MENA) region has broadly held steady despite fears that pipeline opportunities would dry up this year, according to IJGlobal data.

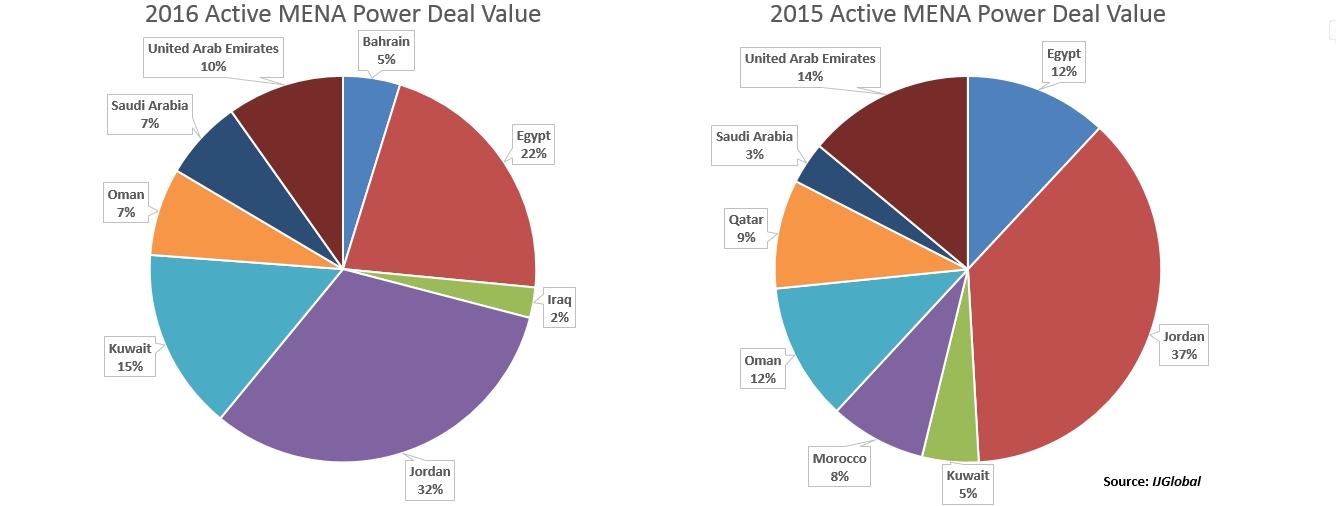

The total value of power transactions in MENA, excluding renewables, that were active (had seen material progress over the preceding 36 weeks) as of 25 April 2016 was approximately $31.4 billion. This was down slightly from roughly $32.6 billion as of 25 April 2015.

The addition of $2.3 billion in new power projects in Iraq and Bahrain and an increase in the value of Kuwait's power pipeline by $3.24 billion have partially offset decreases in power procurement elsewhere in the region. Most significantly Morocco has seen a decline of $2.6 billion in active projects since April 2015, while the pipeline in Jordan is down by $2 billion.

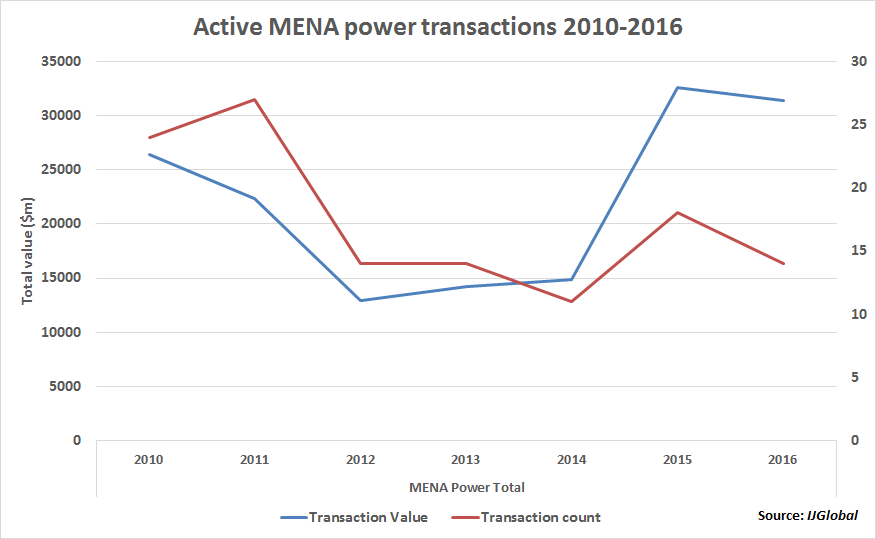

But pipeline opportunities for the MENA power sector are, on the whole, healthier than they have been in recent years. Although the number of active transactions have dropped from 18 to 14 in the year to 25 April 2016, transaction value has suffered less. The result is that the average value of transactions is still significantly higher than it was between 2012 and 2014. Though deal count has not revived from the crash in activity seen in 2012.

A number of active transactions in the market did not contribute to the total value because their cost is not yet known. The massive 1,800MW Al-Khairan independent water and power producer in Kuwait as well as the 1,400MW Fadhili combined heat and power plant in Saudi Arabia for instance were not included; though each is a significant deal in the market.

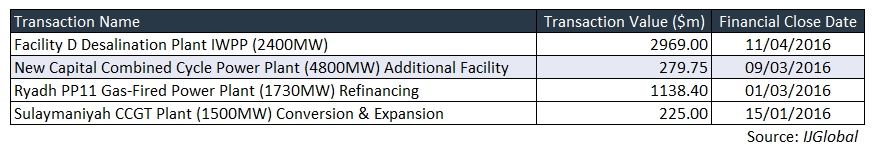

Since the start of the year, $4.6 billion of power projects have reached financial close, further reducing both the total number and value of active transactions.

Outside of conventional power, there has been a proliferation of renewables projects launched in the region over the last year. Active renewables transactions in MENA have grown from $6.9 billion to $7.9 billion since 25 April 2016. But while renewables procurement programmes, such as those being undertaken by ADWEA in Abu Dhabi and DEWA in Dubai, are grabbing headlines, data shows that the conventional power pipeline is also in good health.

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.