Data Analysis: PJM holds steady

Oil and gas prices continue to decline, dragging competitive power prices down with them and dislocating US equity and debt markets. But there is little sign of this in the PJM power market, where projects keep flowing and where financing terms remain steady, according to IJGlobal data.

PJM is a regional transmission organization (RTO) that coordinates the movement of wholesale electricity in all or parts of 13 states in the north-east of the US. There are 10 RTOs operating in the country.

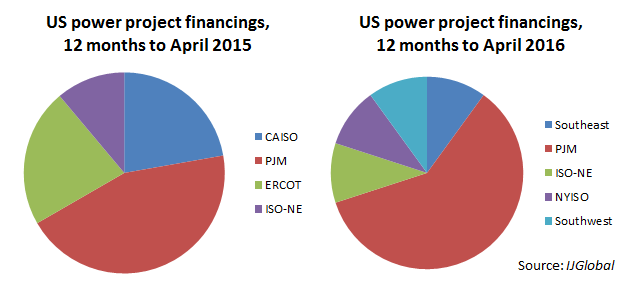

Of the nine greenfield project financings in the power sector closed in the US from mid-April 2014 to mid-April 2015, PJM accounted for four. For the same period one year on, six projects (including one deal for battery storage) were in PJM, with other sectors accounting for one project each.

That trend looks likely to continue this year, with at least three new PJM merchant power projects seeking finance: Panda Power Funds’ 850MW Mattawoman, Tenaska’s 925MW Westmoreland, and Invenergy’s 1.4GW Lackawanna project.

To an extent, PJM is benefiting from a lack of opportunities elsewhere. Power prices have become particularly depressed in ERCOT and CAISO, with encroaching renewable generation a particular issue in the latter. In the southwest, meanwhile, slow retirement of coal-fired generation has made life difficult for existing merchant plants, never mind new ones.

The ISO-NE and NYISO markets remain attractive, as evidenced by the recent close of Towantic in the former and the Cricket County project advancing in the latter. But PJM benefits from a larger market size than either and, in the last year, more generous capacity payments that have seen projects for 2018-19 clear its capacity auction at over $160 per MW-day – more than double the highest clearing price in the MISO auction that closed on 14 April.

Nor is there any evidence of market conditions putting pressure on pricing and tenors in PJM project financings, as the recent and past deals below show. One possible reason for this is given in a recent S&P report on the US capacity market, which cites PJM data showing a declining cost of new entry – in other words, greenfield power projects are becoming more competitive per megawatt-day, driven by natural gas overproduction.

|

Project name |

Financial close date |

Term loan tenor |

Pricing (bps over Libor) |

|

St Charles |

08/08/2014 |

C+5 years (8yrs) |

350 |

|

Carroll County |

07/04/2015 |

C+5 years (7.9yrs) |

325 |

|

St Joseph |

24/11/2015 |

C+5 years (7.8yrs) |

325 |

|

Lordstown |

06/04/2016 |

C+6 years (7yrs) |

325 |

|

Westmoreland |

In financing |

C+5 years (7.5yrs) |

325

Source: IJGlobal data |

Request a Demo

Interested in IJGlobal? Request a demo to discuss a trial with a member of our team. Talk to the team to explore the value of our asset and transaction databases, our market-leading news, league tables and much more.